The Middle East boasts an extensive history of beauty rituals and skin-care practices that go back many centuries. While certain traditions may stay the same—such as the use of oud-based perfumes—this region’s approach to beauty has shifted radically within the last few years due to a rise in disposable incomes, urbanization, and a growing young population, which has only expanded the consumer base for cosmetics and contributed to the growth of the beauty industry in this emerging region.

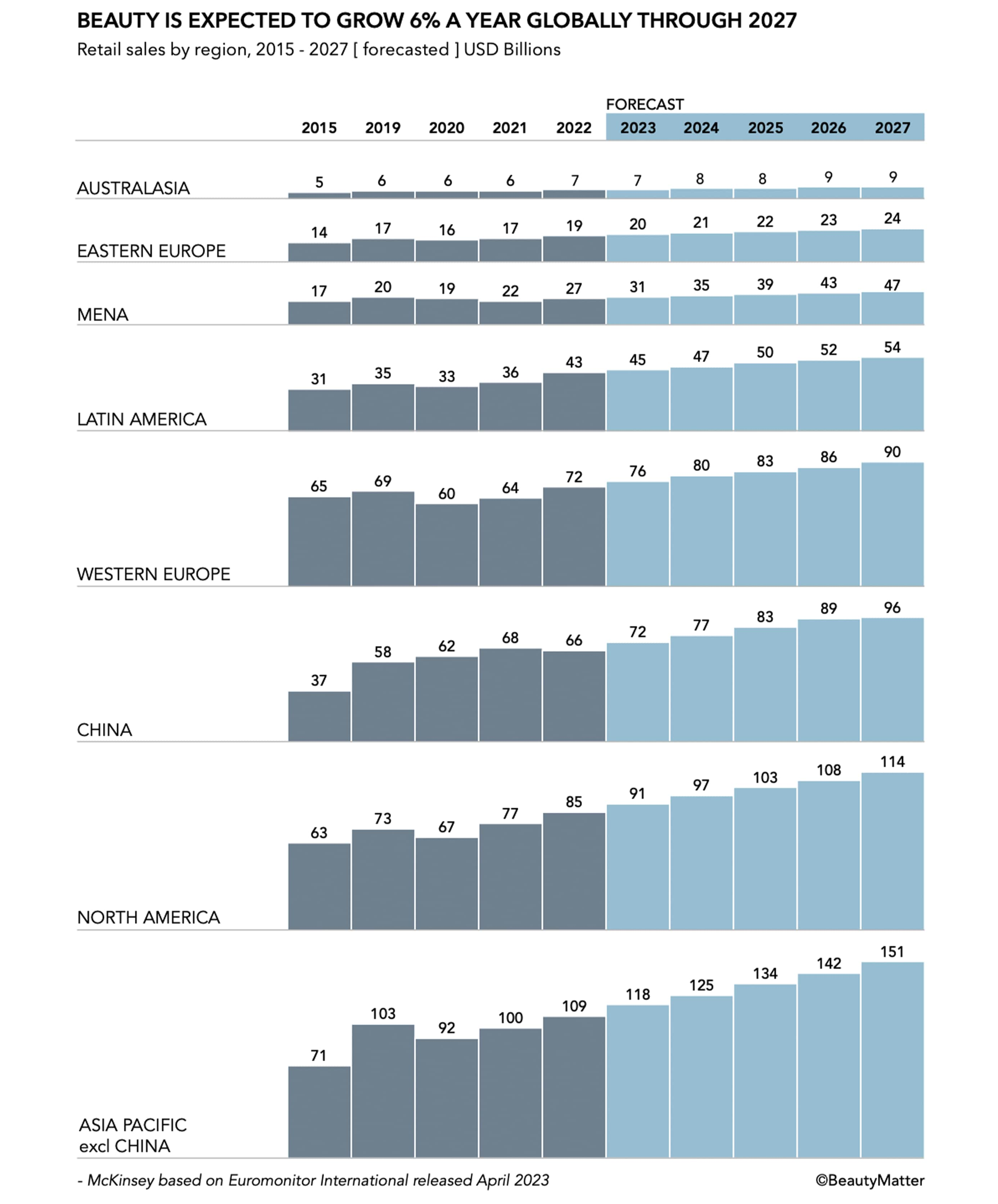

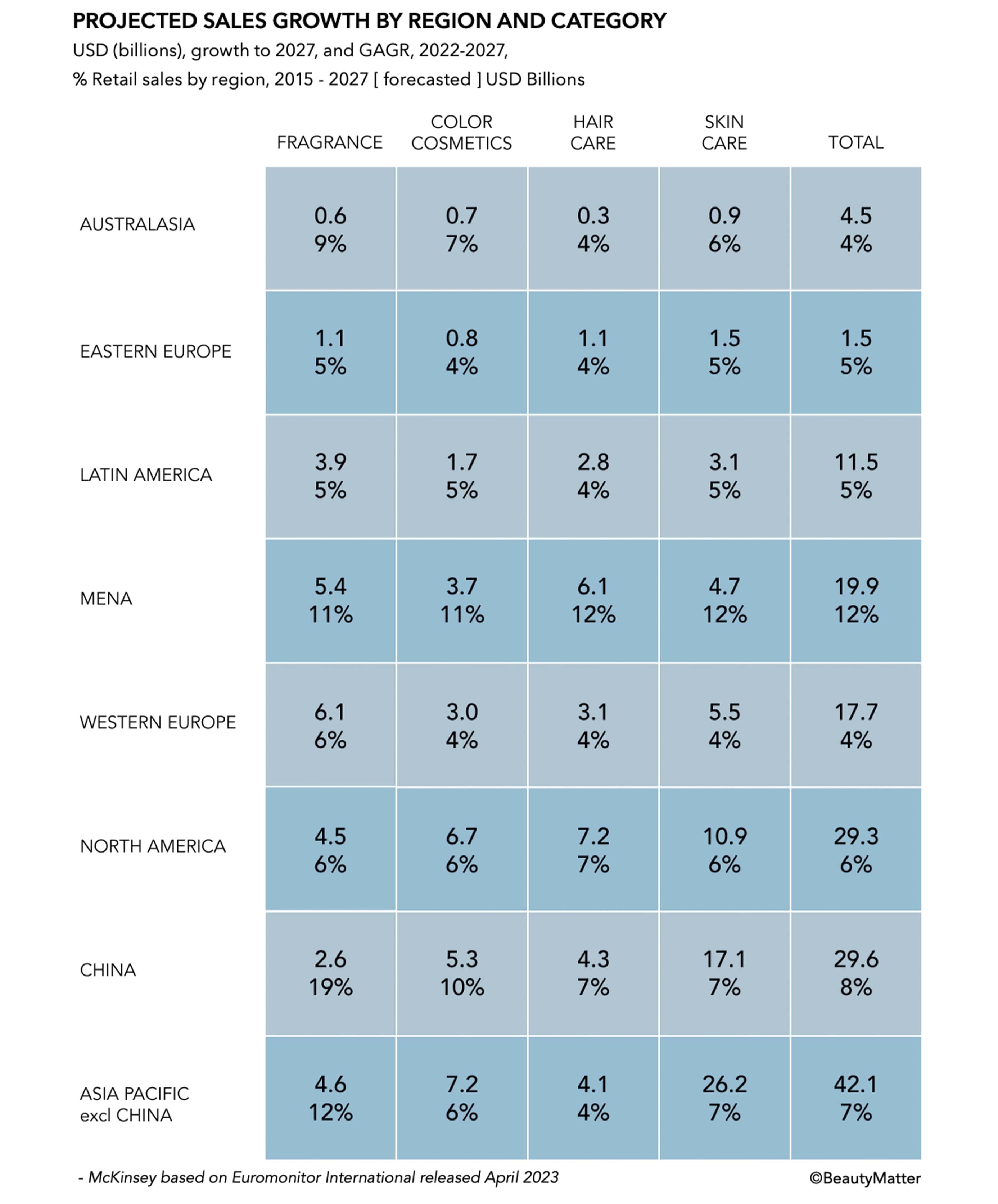

Middle Eastern women, regardless of social class or age, have traditionally used more personal care and beauty products than women in Western cultures. With its rich history and rapidly evolving society, the Middle Eastern beauty market is one of the most lucrative beauty and wellness markets in the world, according to Euromonitor International. The market research firm values the beauty and personal care market in the broader Middle East and North Africa (MENA) region at over $46 billion and estimates it will reach around $60 billion by 2025. The area’s growing population and increased disposable income contribute to the increased demand for beauty products from both local and foreign brands.

Because this region holds a significant portion of the world’s oil and natural gas reserves, the Middle East has remained largely unaffected by the global cost of living crisis despite the tensions in the area. Fueled by a strong economy, booming tourism, and an increase in government infrastructure spending, this region currently holds the highest global consumer spending on makeup and skincare. Women in the Gulf (Bahrain, Kuwait, Oman, Qatar, Saudi Arabia, and the United Arab Emirates (UAE)) spend an average of $63 on makeup and $52 on skincare per month, with men spending an average of $16 per month on skincare.

Saudi Arabia’s economic output is becoming increasingly diversified, with a plan to spend more than $3.2 trillion to transform its economy by 2030. The country hopes to end its dependence on oil revenue while developing sectors such as tourism, entertainment, and sustainability. The Saudi Public Investment Fund has been deploying capital to help stimulate private sector investment, which has resulted in increased dis-posable incomes and consumer spending on luxury items, including beauty products.

The Middle East’s younger demographic points to future market growth, with an average consumer age of only 32. Multiple countries across the region report similar demographic trends. In the UAE, 60% of the population is under 25, and with a population of 80 million, Egypt’s median age is 24, and in Saudi Arabia roughly 70% of the population are under 30. Consumers in Saudi Arabia and the UAE are the highest spenders in the Middle East due to their younger age demographic. This youthful and tech-savvy demographic grew up with an appreciation for beauty, which they picked up from older generations, and which has only grown as they get older. They spend significantly more on cosmetics and are more likely to experiment with new products than the previous generation.

Traditionally, gender segregation has been prevalent in the Middle East, resulting in women spending much of their time in the company of other women. Girls learn the importance of beauty and engage in small acts of beautification from a very young age. Through beauty rituals, products, and techniques, they forge bonds with other women.

However, recent social reforms have ushered in a new era, granting women the opportunity to question and challenge traditional gender roles and participate more actively in society. In Saudi Arabia, women who were previously confined to domestic roles are now increasingly visible in public spaces pursuing careers. The surge in female employment rates has provided women with newfound financial independence, enabling them to manage their own finances and make independent spending decisions.

While beauty was once considered a private affair, shared primarily among women, it has now evolved into a symbol of shifting social and cultural norms. Today, beauty serves as a platform for women to assert their identities and express themselves more openly in public spheres.

Arab women view the digital world as an online expansion of their real-life community, with 71% of all women participating in social networking. The Middle East has witnessed significant growth in e-commerce and social media in the last 10 years. Saudi Arabia, in particular, stands out, boasting one of the world’s highest online content consumption rates at 82%. Saudi women value femininity and look to social media for makeup inspiration. Saudi Arabia boasts the most engaged users of makeup and fragrance. In 2021, the Saudi beauty sector was valued at $3.82 billion, but experts predict it could attain a valuation of $5 billion in the near future. Driven by a digital transformation, the increased demand has attracted global companies to invest in the Saudi beauty market, which in turn has provided Saudi women with more options when it comes to beauty products they can use to express their individuality and celebrate Arabic beauty.

Due to the region’s long history of wearing makeup and how fast consumer behaviors and expectations are changing, makeup trends in the Middle East tend to lean towards heavier makeup. A popular expression in Saudi Arabia is “Wishik yohmoul,” which literally means your face and coloring can take a more full makeup look. Unlike white women with light skin and smaller features, Arab women tend to have big eyes, full lips, and thick brows, meaning that they can experiment with pops of colors and different techniques with-out looking over-the -top.

Beauty consumers in the Middle East have unique needs and preferences when it comes to makeup and skincare. The extreme weather conditions can be tough on their skin, and any makeup they wear needs to be able to withstand intense dry heat, excessive humidity, and everything in between. Recently, the region has seen a rise of A-beauty (Arab beauty) brands and products designed to meet these needs and resonate deeply with the new Middle Eastern consumer. Like J-beauty and K-beauty, A-beauty embraces native ingredients and builds on cultural traditions to create products that cater to the diverse populations of Arab regions. Brands like Asteri Beauty and Huda Beauty are leading this trend.

Beauty standards have recently shifted in favor of common Arabic and Middle Eastern features: full lips and cheeks, thick eyebrows, prominent cheekbones, and big eyes replaced the Western and white beauty ideals that became the global beauty standard starting in the late nineteenth century. The popularity of celebrities like Kim Kardashian and Huda Kattan led to a shift from European beauty ideals to a celebration of Arabic beauty and Middle Eastern features. Arab women want to enhance the natural features that make them the new ideal beauty standard, which white women today pay a hefty price to achieve.

The Middle East stands out as a dynamic market for the beauty and wellness industry and is positioned as a prime destination for growth and innovation. Social reforms have empowered women to deepen their involvement in the public sphere and take control of their lives, and many women view beauty as an avenue of self-expression. The rise of digital connectivity through social media has led to increasing demands in the market for beauty products that resonate with Middle Eastern consumers and their unique needs. As this market evolves, it will continue to shape global trends by building on its rich cultural heritage. Brands that authentically embrace and celebrate the essence of Middle Eastern beauty will be well-positioned to succeed in this emerging market.